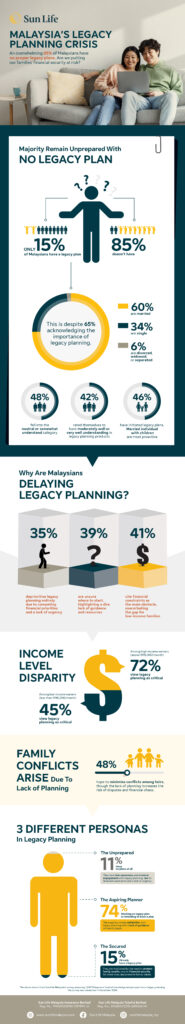

KUALA LUMPUR, 19 March 2025 – Sun Life Malaysia’s “Insure or Unsure: Sun Life Insurance Literacy Survey 2025” has uncovered a significant gap in legacy planning among Malaysians, with 85% unprepared to secure their family’s financial future. Despite a rising awareness of the importance of legacy planning, the survey shows that a small percentage of the population has taken concrete steps towards family wealth management.

The survey, which was conducted with 1,040 Malaysians from different income groups and regions, found that while 65% acknowledge the necessity of legacy planning, only 15% have actively worked to secure their family’s financial future. This disconnect poses a risk to many families, leaving them vulnerable to financial instability and potential family disputes.

Rising Awareness, But Progress Is Slow

Sun Life Malaysia’s survey revealed a slight improvement in insurance/takaful literacy, which rose from 28% in 2023 to 35% in 2024. However, 23% of Malaysians still lack basic understanding of insurance and legacy planning, emphasizing the need for ongoing educational initiatives.

Raymond Lew, President/Country Head of Sun Life Malaysia, remarked, “While we’ve made progress in raising awareness, the reality is that the majority of families remain unprepared, risking financial insecurity for their loved ones. A more unified approach that takes into account Malaysia’s cultural diversity, along with accessible legacy planning tools, is critical to reversing this trend.”

Cultural Nuances and Financial Challenges

The survey revealed that married individuals with children are most likely to recognise the importance of legacy planning. However, despite their awareness, most still have not implemented solid plans. Cultural and religious beliefs also play a significant role in shaping legacy planning practices, with Malay respondents often preferring Islamic inheritance tools, such as Hibah and Wasiat, in alignment with Shariah law.

The survey highlights several key barriers preventing Malaysians from prioritising legacy planning:

- Financial Constraints (41%): Many low-income families, especially those earning below RM5,249/month, are unable to allocate resources for legacy planning.

- Lack of Knowledge (39%): Many Malaysians feel unsure about where to start, revealing the need for accessible resources and guidance.

- Competing Financial Priorities (35%): Immediate financial needs take precedence, particularly for singles and childless couples.

A Growing Wealth Gap in Legacy Planning

The survey also revealed a growing divide between high-income and low-income earners in terms of legacy planning. Among those with more than RM5,000 monthly household income, 72% consider legacy planning important. In contrast, only 45% of individuals with a monthly income below RM2,000 view it as necessary. Furthermore, 68% of those without a legacy plan belong to the lower-income group, creating a wealth inequality issue that needs urgent attention.

The Risk of Family Disputes

Without a clear legacy plan, families are more likely to face disputes, especially in Malaysia’s multicultural society and with the increasing number of blended families. The survey found that 48% of Malaysians cited minimizing conflicts as a primary concern, with blended families leading in proactive legacy planning (82%) compared to nuclear households.

Raymond Lew added, “The absence of proper financial planning doesn’t just affect families’ financial wellbeing—it can lead to relational conflicts, especially in Malaysia’s diverse family structures. Ensuring both financial stability and family harmony is crucial, and legacy planning plays a vital role.”

A Path Forward: Empowering Malaysians with Knowledge and Tools

While insurance literacy has improved, there is still a significant gap in understanding, with 23% of respondents lacking basic knowledge. To tackle this, Sun Life Malaysia continues its InsureLit campaign, which aims to raise awareness around financial literacy and legacy planning.

“We’re excited to see the rise in insurance literacy, thanks to our InsureLit campaign. However, there’s still much work to be done to ensure every Malaysian is financially protected,” said Lew.

The Road Ahead

Looking to the future, Sun Life Malaysia plans to expand its efforts in 2025 with digital resources, roadshows, explainer videos, and youth financial literacy programs. These initiatives aim to provide Malaysians with the tools they need to secure their financial future, addressing the urgent need for widespread education on legacy planning.

“Malaysia’s families form the backbone of our society, and empowering them with the knowledge and solutions to secure a prosperous future is crucial,” concluded Lew. “We must work together—financial institutions, policymakers, community leaders, and individuals—to ensure that legacy planning is accessible and relevant for all Malaysians.”

By amplifying its efforts through the InsureLit campaign and other initiatives, Sun Life Malaysia is committed to bridging the knowledge gap and ensuring that families across the nation are prepared to face the future with confidence.