The Association Urges Government to Reassess EPF Proposal to Prevent Strain on Businesses and Rising Consumer Costs.

Kuala Lumpur, October 27, 2024 – The Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM) urges the Government to reconsider the proposal in the 2025 Budget to mandate compulsory Employees Provident Fund (EPF) contributions for all non-citizen workers. ACCCIM emphasises the need for a balanced approach to prevent financial burdens on businesses, especially Micro, Small, and Medium Enterprises (MSMEs).

According to the proposal:

1. For new contracts, both employer and employee contributions will match the rates for Malaysian employees, with 11% from employees and 12% or 13% from employers, depending on the wage level.

2. For existing contracts, contributions will begin at 2% from both employers and employees, increasing gradually over six years until aligned with the rates for Malaysian workers.

Impact on Businesses and MSMEs

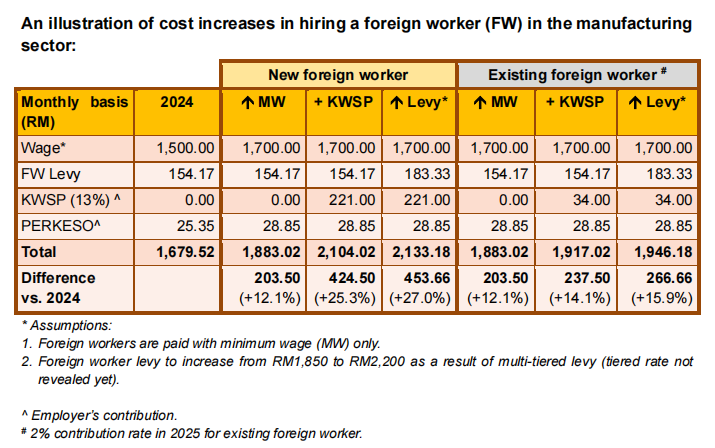

ACCCIM expresses concern that the proposed EPF contributions, combined with other policy changes – including the 13.3% increase in the minimum wage (from RM1,500 to RM1,700), the multi-tiered foreign worker levy, and higher fuel and SST costs – will significantly raise operating expenses.

For example, under the new minimum wage structure:

– A foreign worker in the manufacturing sector earning RM1,700 per month would cost employers an additional RM454 per month due to EPF contributions and levies—a 27% increase compared to 2024.

– For existing foreign workers, hiring costs would rise by RM267 per month, representing a 15.9% increase.

Companies struggling to absorb these costs may transfer them to consumers, leading to higher inflation and increased pressure on the cost of living. This could also dampen consumer spending, affecting economic growth.

ACCCIM questions the rationale for mandating EPF contributions for non-citizen workers, noting that foreign workers are already covered under SOCSO for social protection and the Foreign Worker Hospitalisation and Surgical Scheme for medical coverage. If the aim is to safeguard workers’ economic welfare, the Government could consider requiring only employee contributions, with employers exempted from contributing.

Additionally, ACCCIM highlights possible challenges:

– Foreign workers may demand higher wages to offset reduced take-home pay or opt for illegal employment to avoid EPF deductions.

– Increasing the cost of hiring foreign workers to encourage the employment of locals may backfire, as many locals are reluctant to take up 3D (dirty, dangerous, and difficult) jobs, potentially disrupting key sectors.

– Withdrawing EPF savings upon returning home could strain EPF fund management, which already faces challenges in delivering competitive dividends to contributors.

ACCCIM is concerned that many industry stakeholders were not adequately consulted in developing this proposal. It calls on the Government to engage with industry groups to ensure the policy is fair and feasible.

“We again reiterate that significant rise in operating costs will be detrimental to MSMEs and a sequencing of policy measures is desirable as measured pace of cost increases are easier to bite and make it possible for the businesses to adapt to the new cost structure over time.” ACCCIM stated.

The Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM) represents the interests of the Chinese business community across Malaysia. It plays a key role in advocating for sustainable economic policies and fostering a competitive business environment.