Kuala Lumpur, 13 February 2025 – AEON Bank (M) Berhad, Malaysia’s first Islamic digital bank, has partnered with MADCash Sdn. Bhd. to empower 100 female entrepreneurs from B40 communities to start and grow their businesses. The ‘GrowthStart’ programme is part of Bank Negara Malaysia’s iTEKAD initiative, aimed at uplifting microentrepreneurs in underserved communities across the nation.

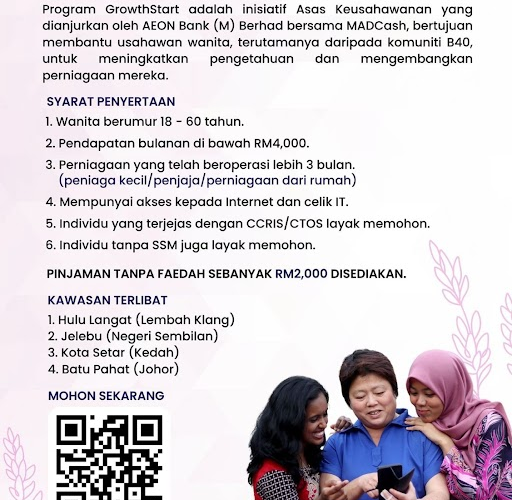

Developed in collaboration with MADCash, a local fintech enabler focusing on female empowerment, the programme provides training, mentorship, and financial tools to help women entrepreneurs leverage digital solutions and financial technology. Running from February 2025 to August 2026, the programme will be implemented in three phases, with participants selected from Selangor, Kedah, Negeri Sembilan, and Johor.

In the first phase, 50 female microentrepreneurs from diverse sectors such as F&B, education, health and beauty, agriculture, and social enterprises will be chosen to take part in workshops, both in-person and online, and receive coaching. This will run from February to August 2025. The second and third phases will involve 25 female entrepreneurs each, over six-month intervals. Each participant will also be eligible for RM2000 Qard financing, in line with AEON Bank’s Shariah principles.

YM Raja Datin Paduka Teh Maimunah Raja Abdul Aziz, CEO of AEON Bank, commented, “The ‘GrowthStart’ programme reflects our commitment to financial inclusion by providing support to female microentrepreneurs with untapped potential. Many of these women face barriers in securing funding and require the right tools and mentorship. Through this partnership with MADCash, we are offering seed capital, business coaching, and digital skills training to empower them. This programme is not only about individual success but also about creating broader community impact and driving lasting social change.”

Nuraizah Shamsul Baharin, CEO of MADCash, added, “At MADCash, we are dedicated to helping women develop the skills and knowledge they need to improve their livelihoods. With a stronger economic foundation, they can overcome challenges and enhance their financial independence. This collaboration with AEON Bank is a step toward promoting greater financial inclusion in Malaysia.”

AEON Bank remains committed to offering accessible financial solutions to all Malaysians and continues to contribute to the growth of Islamic banking and the digital economy, fostering a more inclusive financial future for the nation.