The Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM) has released its latest Malaysia’s Business and Economic Conditions Survey (M-BECS), capturing business performance for the second half of 2024 (2H 2024) and expectations for the first half of 2025 (1H 2025). Conducted between 18 November 2024 and 15 January 2025, the survey gathered insights from 630 respondents, with micro, small, and medium enterprises (MSMEs) comprising 88.3% of participants.

ACCCIM President, Datuk Ng Yih Pyng, highlighted that businesses remain cautiously optimistic about economic and business prospects despite mounting challenges. Chief among concerns is the persistent rise in operating costs, exacerbated by multiple cost-increasing measures set for implementation this year. These include a higher minimum wage, mandatory Employees Provident Fund (EPF) contributions for all non-citizen workers, a multi-tiered foreign worker levy, the introduction of e-invoicing, the rationalisation of RON95 petrol subsidies, and a proposed hike in electricity tariffs.

Key Summary of Findings

Most businesses have a neutral view on Malaysia’s economic and business conditions, expressing concerns over increasing business costs as well as compliance requirements and regulations.

- The heightened external uncertainties surrounding the US trade tariffs policy and its knock-on effect on global economic growth and trade, have clouded the prospect of Malaysia’s export sector and ensuing negative spillover on domestic economy.

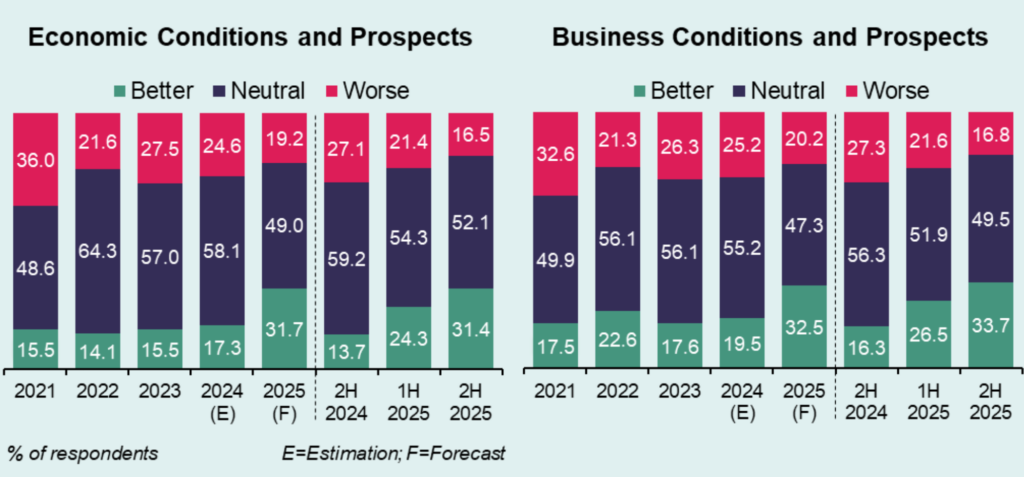

- In 2H 2024, over half of the respondents (59.2%) held a neutral view on economic conditions while maintaining a neutral outlook for both 1H 2025 and 2H 2025. On a positive note, respondents expect a gradual improvement in outlook, with 31.7% feeling more optimistic about 2025 compared to 17.3% in 2024. Fewer respondents (19.2%) have a worse outlook for 2025 compared to 24.6% in 2024.

- Likewise, a majority of respondents (56.3%) had a neutral view on business conditions in 2H 2024, 51.9% for 1H 2025 and 49.5% for 2H 2025. For 2025, 32.5% of respondents foresee a better business outlook, up from 19.5% in 2024. Nonetheless, 20.2% expects a worse business performance in 2025.

- Neutral cash flows and debtor conditions were reported by most respondents in 2H 2024 and 1H 2025. In 2H 2024, more respondents reported worse cash flow conditions than better ones, but a turnaround is expected in 1H 2025.

- The top five (5) factors that have adversely affected business performance in 2H 2024 were: (i) High operating costs and cash flow problem (as voted by 50.0% of respondents); (ii) Increase in prices of raw materials (41.3%); (iii) The Ringgit’s fluctuation (40.2%); (iv) Lower domestic demand (39.0%); and (v) Changing consumer behaviour (36.8%).

- Domestic and foreign sales showed improved performance and outlook, though over 35% of respondents reported a weaker sales performance in 2H 2024.

- Cost of local and imported raw materials continued to increase in 2H 2024 and is expected to maintain an upward trend in 1H 2025.

- Domestic price levels increased, while export price levels mostly remained stable in 2H 2024. In 1H 2025, businesses are expected to increase their prices.

Key Issues

(I) China’s Impact on Malaysia’s Businesses: Investments Bring Opportunities and Challenges for Malaysian Businesses

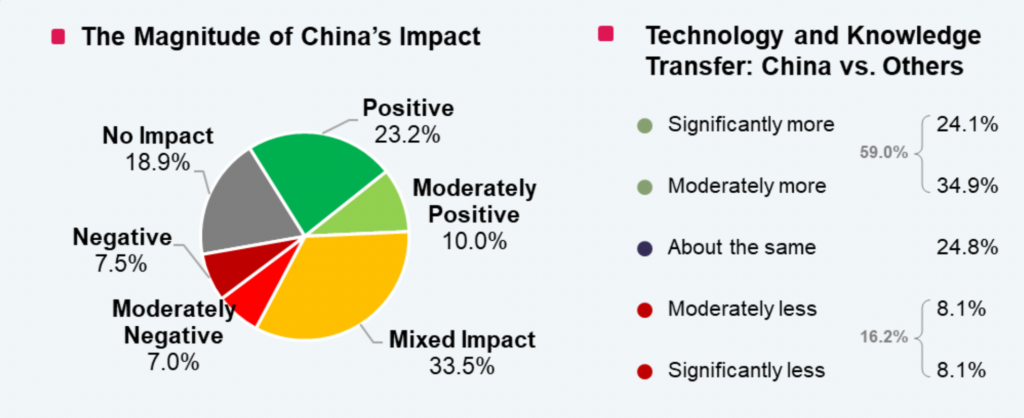

The survey revealed a mixed to positive impact of China’s investments and businesses on Malaysia’s economy. While close to one-third of respondents viewed the impact positively, another third had a mixed perspective, and 14.5% reported negative effects.

Encouragingly, 59.0% of respondents acknowledged that Chinese companies have contributed to technology and knowledge transfer, surpassing other foreign investors. Investments from China in key sectors such as artificial intelligence (AI), green technology, information and communication technology (ICT), and advanced materials are seen as beneficial for Malaysia’s industrial and economic development.

However, concerns remain, particularly regarding hiring practices, with 36.3% of respondents highlighting that Chinese firms tend to fill key positions with talent from China, potentially limiting opportunities for local professionals. Additionally, businesses are wary of market erosion and the crowding-out effect on domestic players. To navigate these challenges, businesses are calling for stronger government support.

Key recommendations:

- Encouraging joint ventures with local businesses (65.1%)

- Addressing unfair trading practices (44.3%)

- Prioritising firms with higher local content (39.2%)

- Setting conditions for technology and skill transfer (39.0%)

- Facilitating greater market access for Malaysian products (38.5%)

Strategic Partnerships:

Datuk Ng Yih Pyng

By collaborating, Malaysian businesses can enhance their competitiveness, access new market opportunities, and position themselves for expansion beyond domestic borders.

(II) Cost-Related Assessment: Rising Business Costs a Major Concern as Malaysia Moves Towards Subsidy Rationalisation

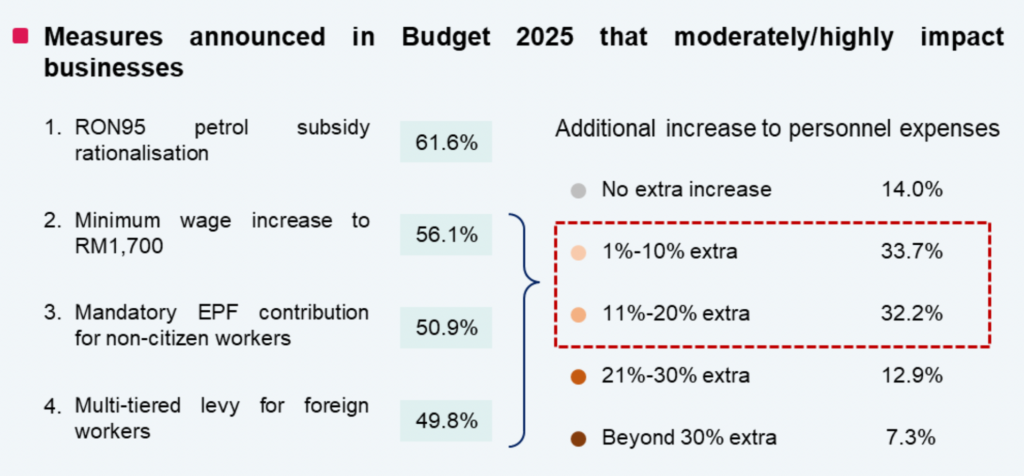

Businesses in Malaysia are bracing for higher operational costs as the Government plans to rationalise the RON95 petrol subsidy by mid-2025. According to the survey, 61.6% of respondents believe this move will negatively impact their businesses, with 30.0% anticipating a high impact and 31.6% expecting a moderate impact.

Many businesses are still adjusting to the diesel subsidy rationalisation introduced in June 2024, making a gradual approach to subsidy adjustments critical. ACCCIM has cautioned against a free-floating fuel price, warning of broader repercussions on business costs and consumer prices.

Rising Personnel Costs and Financial Strain

Personnel costs—already a significant 30% of total expenses for most businesses—are set to rise further with policy changes introduced in Budget 2025. These include:

- Higher minimum wage

- Mandatory EPF contributions for non-citizen workers

- A multi-tiered levy for foreign workers

A majority of respondents (65.9%) anticipate an increase in personnel costs of up to 20%, while 20.2% expect the rise to exceed 20%. An estimate suggests that businesses will need to allocate an additional RM267 per non-citizen worker per month, a 15.9% increase compared to 2024.

Additionally, businesses are bracing for a proposed hike in electricity tariffs in 2H 2025, which is expected to place further strain on industries—especially manufacturing, capital-intensive, and energy-dependent sectors. These cost surges could create knock-on effects across supply chains, dampening export competitiveness, increasing inflationary pressures, and slowing economic growth.

Calls for Government Support

To mitigate these cost pressures, more than half of the respondents recommend the following measures to ease the cost of doing business:

- Corporate tax rebates for MSMEs (57.2%)

- Increased allocations for soft loans and grants (56.5%)

- Higher preferential tax threshold for SMEs (51.6%)

The targeted support measures will be key to help businesses sustain growth, maintain competitiveness, and ensure economic stability.

Read the full report.